In Fall 2023, TMWA’s financial team identified up to $75M of existing debt at interest rates that could be reduced as a part of TMWA’s ongoing debt management strategy. Unlike a refunding of bonds, which occurs instantaneously, this strategy required TMWA to pay off existing debt from cash reserves, then issue new debt at a lower interest rate. This unconventional strategy required two separate transactions because the existing bonds had not reached their repayment date and were not yet callable. Accordingly, the issuance of new debt was carefully timed and executed.

On December 20, 2023, TMWA successfully repaid $69.8M in outstanding debt using existing cash reserves. Then on January 4, 2024, TMWA purchased bonds with a principal amount of $61.5M. Both the timing and pricing were extremely favorable for TMWA, resulting in a $12.1M reduction of its debt-interest burden.

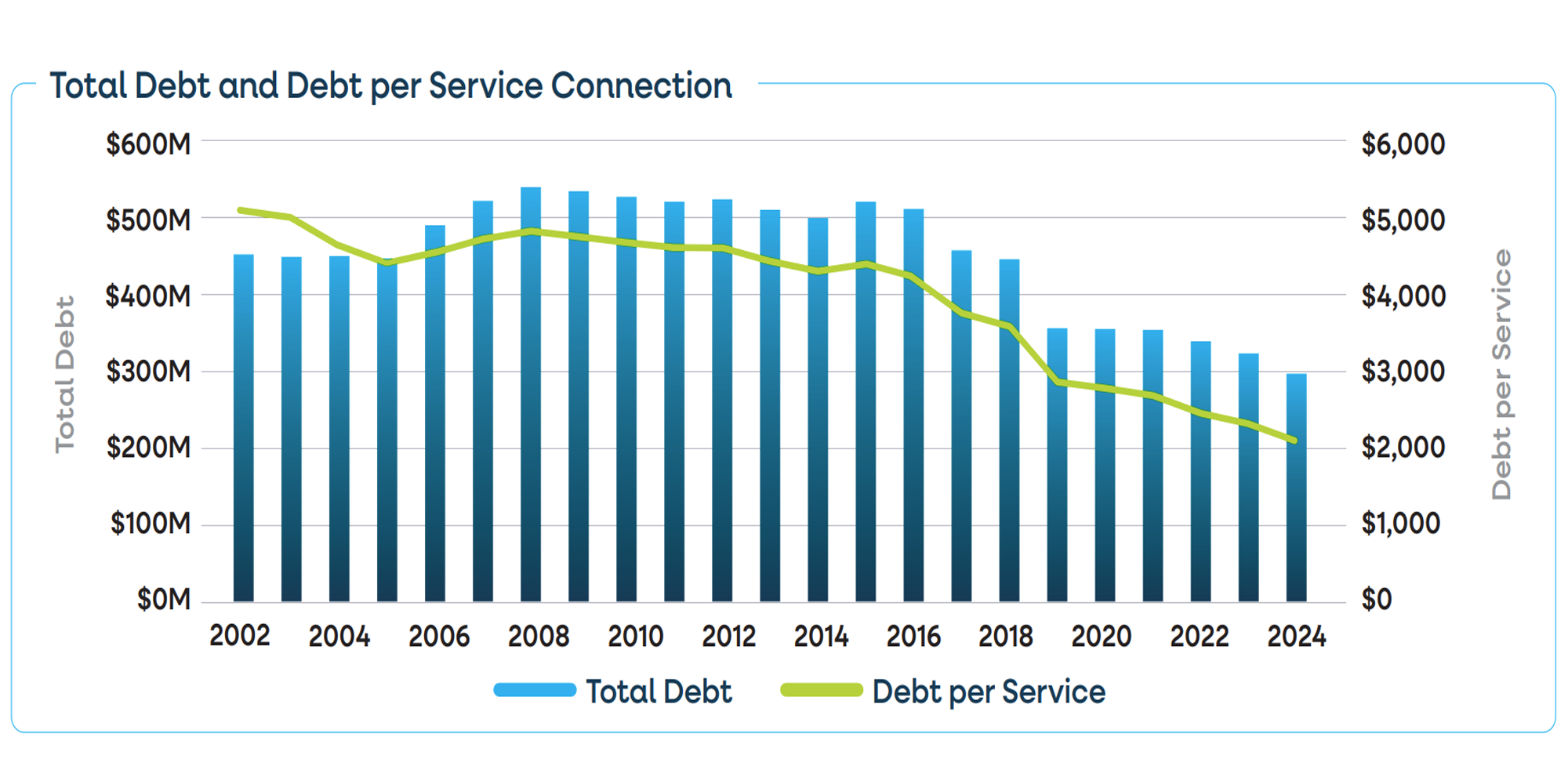

From a TMWA customer perspective, the debt per service connection has decreased 58.4% since the utility was formed in 2001. The debt per service connection in 2002 was $5,009; in 2024 it was $2,084.